Who we help

Business owners / entrepreneurs

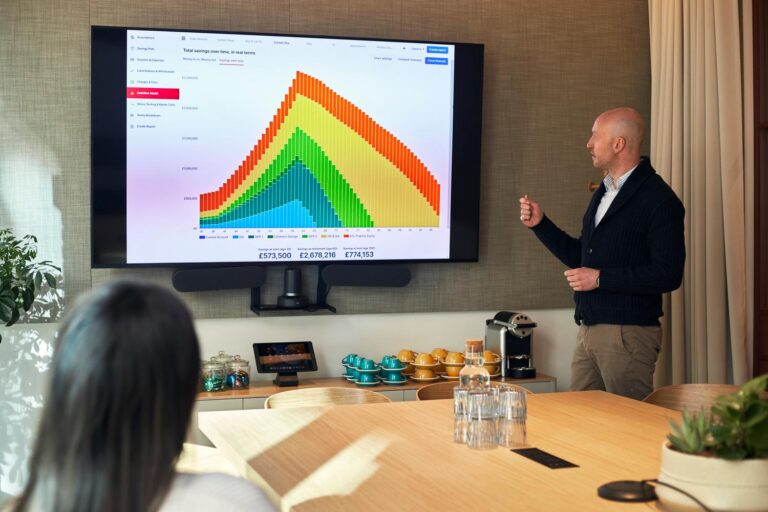

Running your own business comes with a blend of challenges and opportunities. At Betterment Wealth, we support your financial wellbeing at every stage, from launching your enterprise and managing growth to planning for succession and eventual exit.