Welcome to the 2024 Dimensional review from Betterment Wealth. The update is for our clients who are invested in a Dimensional Wealth portfolio (Core, Core Plus or Sustainability).

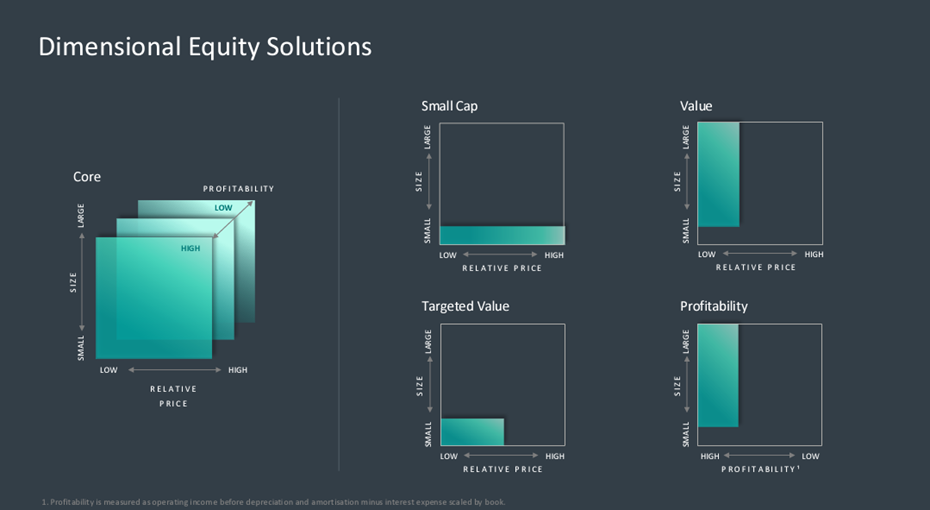

Dimensional tilt toward securities with higher expected returns. As per the image below, equity allocations focus on size, value, and profitability. The fixed income allocations look to term, credit and currency where applicable. The allocations use Dimensional funds designed to go beyond index investing by pursuing higher expected returns in a diversified, cost-effective manner.

We hope you find the following information insightful.

Dimensional produced the following series of charts as part of their 2024 market review; therefore, Betterment Wealth is not accountable for the accuracy of the data.

Past performance is not a guide to future returns. The value of your investment can go down as well as up and you may not get back all that you invested.

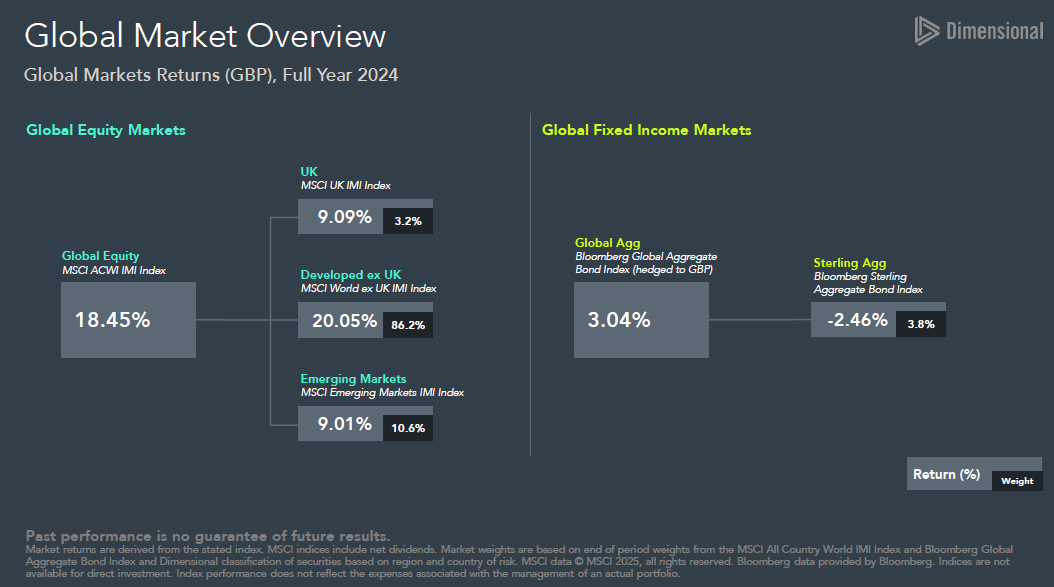

Overall Market Backdrop

- U.S. equities surged in 2024, driven by AI growth and tech sector dominance, despite volatility.

- Political shifts dominate market sentiment: New UK Labour government, Trump’s election win, and South Korea’s martial law declaration.

- Despite early signs inflation was under control, year-end data creates a more cautious stance for central banks going into 2025

Bond markets were shaped by the trajectory of interest rates following one of the most aggressive tightening cycles in recent history. The Fed-funds target rate began the year at 5.25%-5.50%, its highest since the 2008 financial crisis, while the BoE also held rates at 5.25% through the first half. Early optimism for substantial rate cuts, driven by the assumption that inflation would be swiftly contained, faded as inflation remained stubbornly above target. Central banks, including the Fed and BoE, maintained a hawkish stance, delaying the anticipated easing.

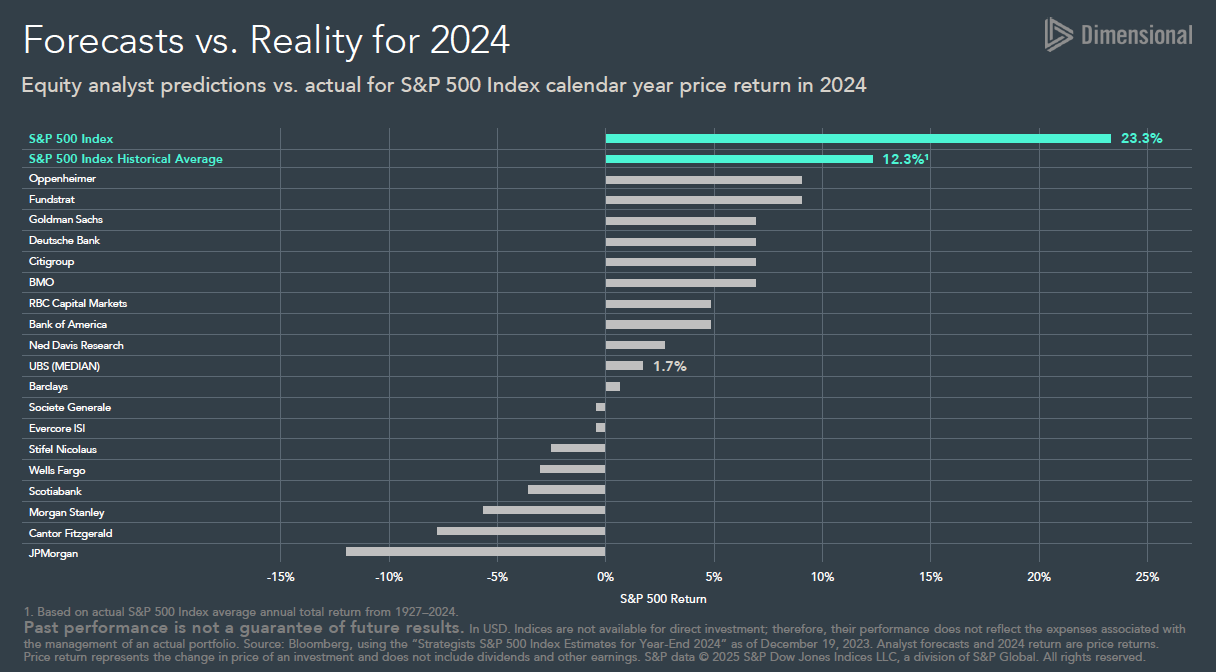

Tune out the Noise – Forecasts Vs Reality

At the beginning of each year, the financial press shares predictions from some prestigious asset managers about global economies and investment markets for the forthcoming year. The next 3 charts look more closely at some of those predictions.

If equity analyst’s forecasts are this inaccurate, we have to question what this means for their management of portfolios.

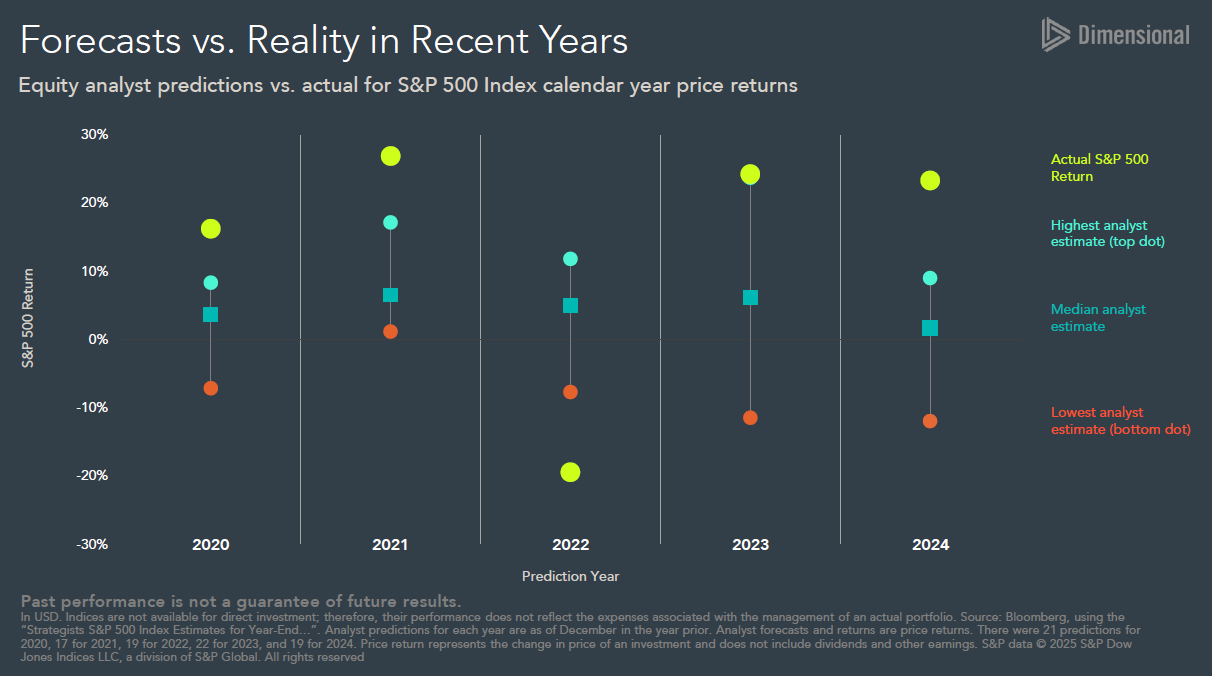

The following chart shows the consistency of just how inaccurate an equity analyst’s predictions are. Betterment Wealth’s message is to ‘tune out the noise’ and stick to a plan that avoids speculation and expensive, actively managed investment services.

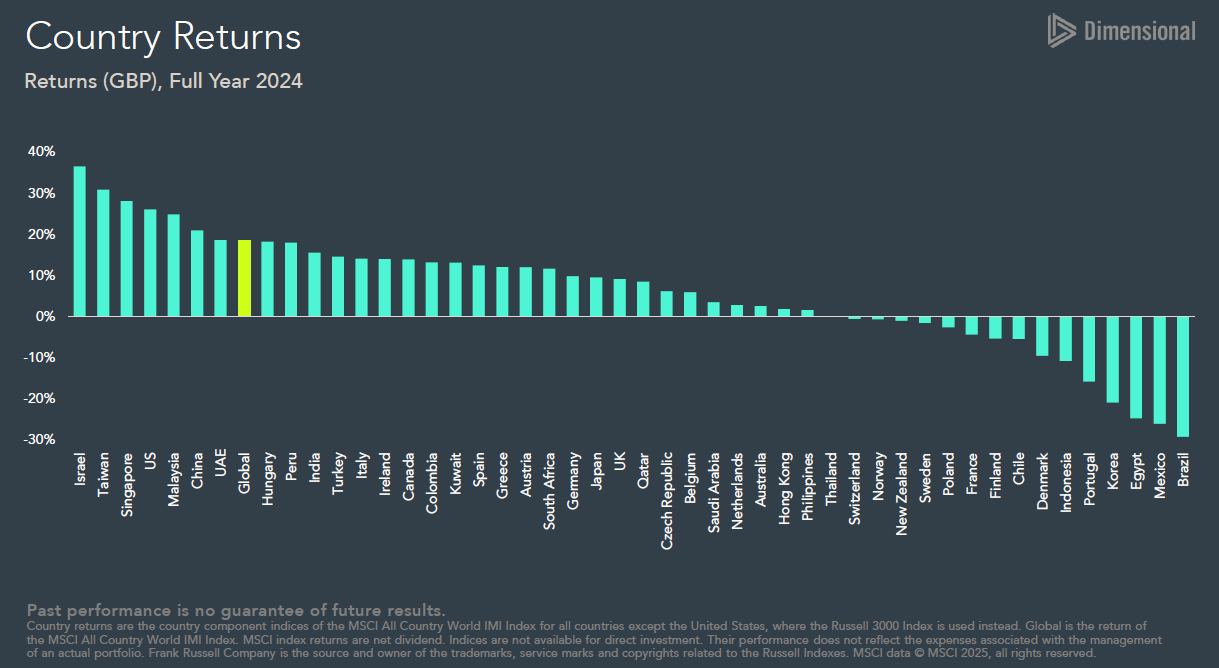

Country Returns

- U.S. equities started the year with a strong rally, as the Dow Jones, Nasdaq, and S&P 500 hit historic highs in Q1, fuelled by optimism surrounding economic growth, potential interest rate reductions, and the booming prospects of artificial intelligence (AI). Despite the volatility and challenges, the U.S. market delivered an impressive annual return, outpacing global equities. This strong performance was driven largely by the tech sector and AI-related gains, even as market concentration and macroeconomic risks posed challenges.

- UK equities navigated a year of modest growth, while Europe excluding the UK lagged significantly.

- Japan and the Asia-Pacific (APAC) ex-Japan region experienced dynamic market shifts, shaped by both domestic developments and broader geopolitical events. The Bank of Japan (BoJ) ended its era of negative interest rates, boosting investor confidence and positioning Japan as a preferred regional choice amid China’s ongoing struggles.

- Emerging markets experienced a volatile yet ultimately positive year.

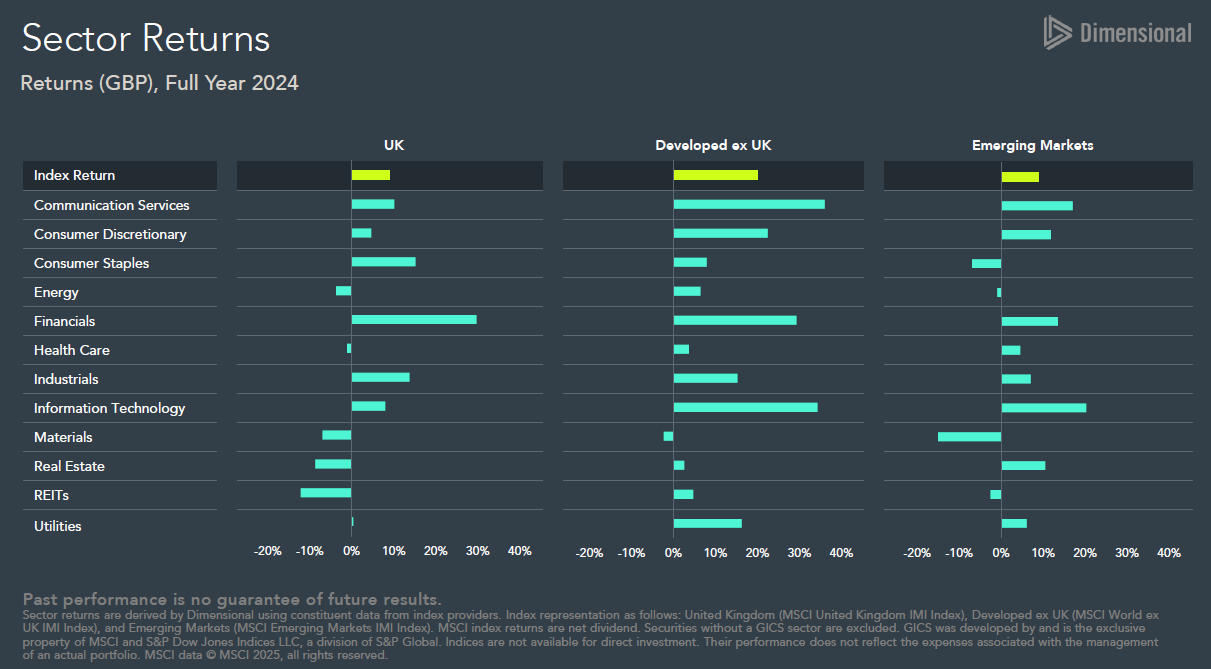

Sector Returns

- Despite volatility, equities surged in 2024, driven by AI growth and tech sector dominance.

- Excluding the UK, there were not too many sectors that posted negative returns.

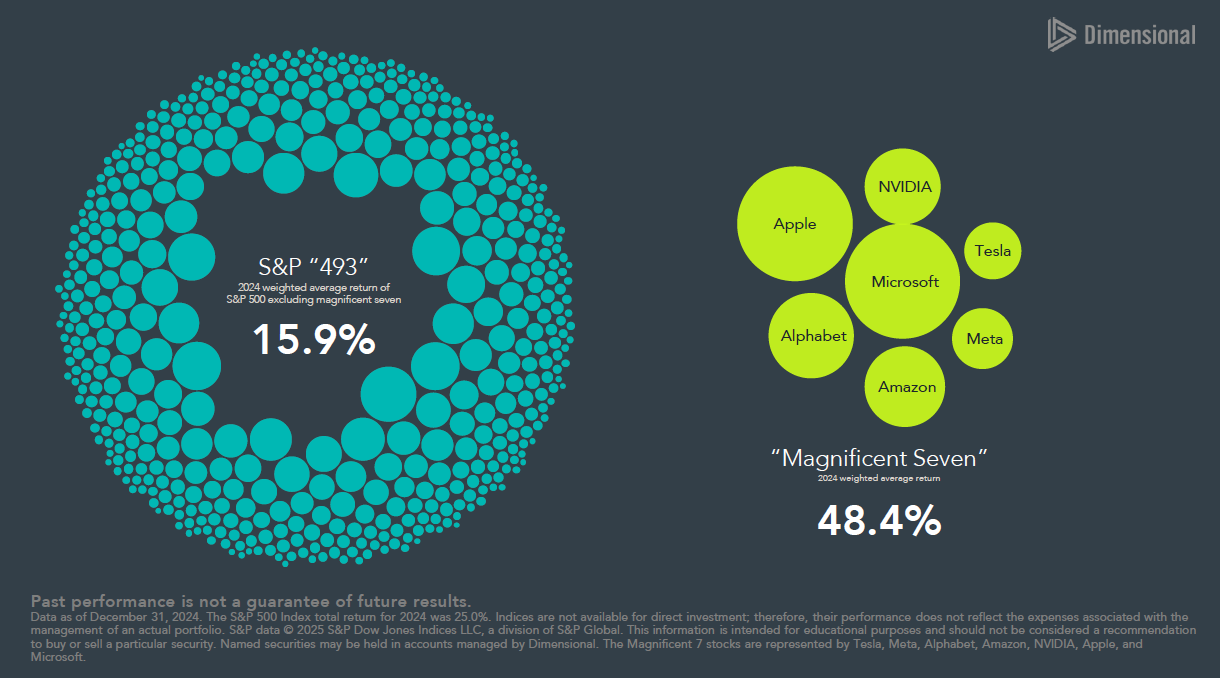

The “Magnificent Seven”

The “Magnificent Seven” once again posted strong returns in 2024, but it’s reassuring that the other companies making up the S&P 500 also posted above-average returns.

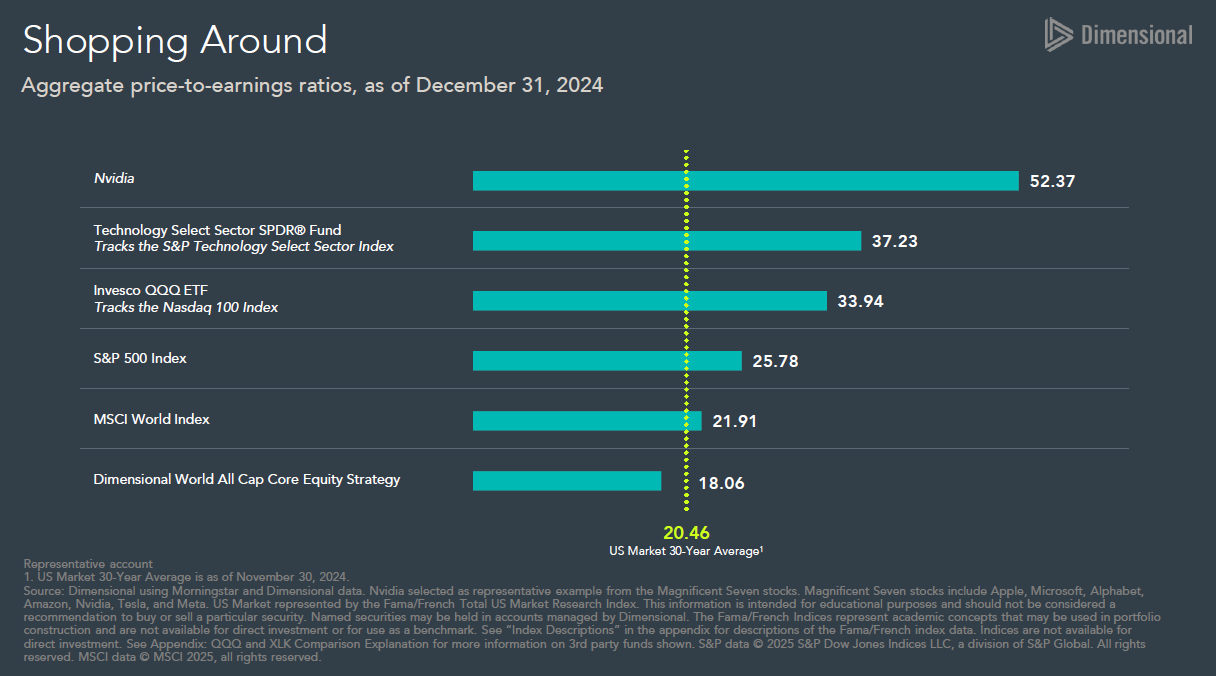

Price to Earnings Ratios

We continue to see whether the “Magnificent Seven” continue to be “Magnificent”. The technology sector’s price-to-earnings ratio (their valuation in relation to their expected earnings) is significantly higher than the US market 30-year average. If the earnings data of the technology sector fall short of expectations, we could see the valuations for these companies adjust downwards.

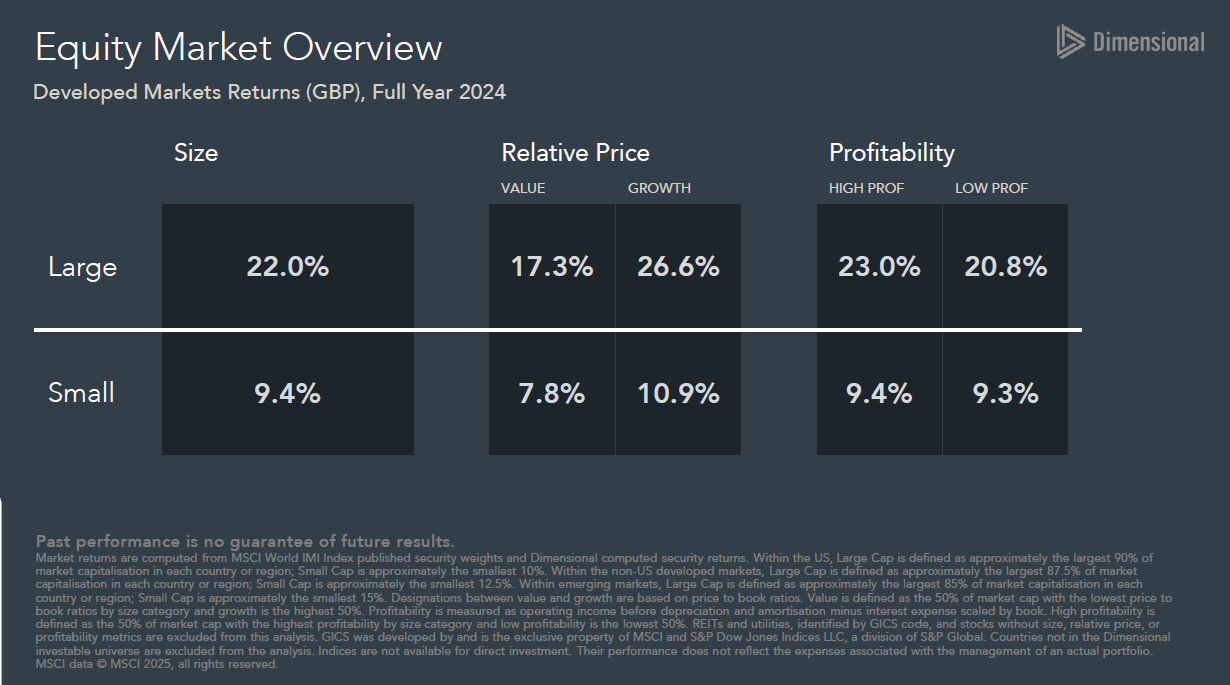

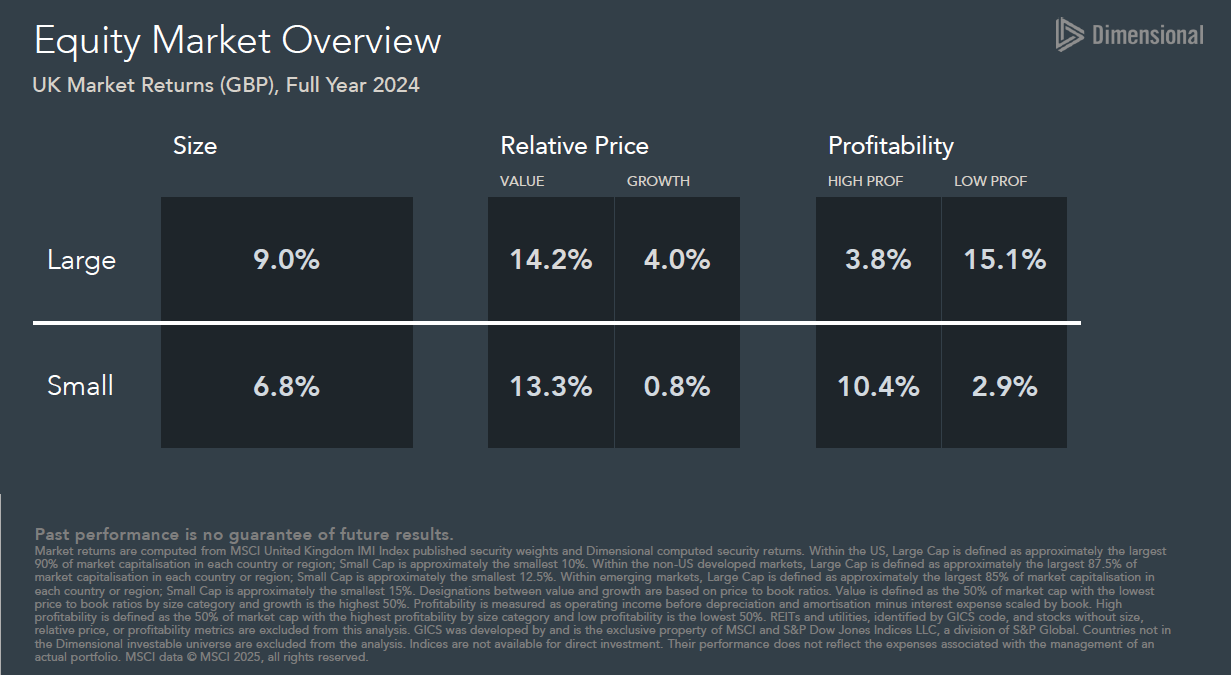

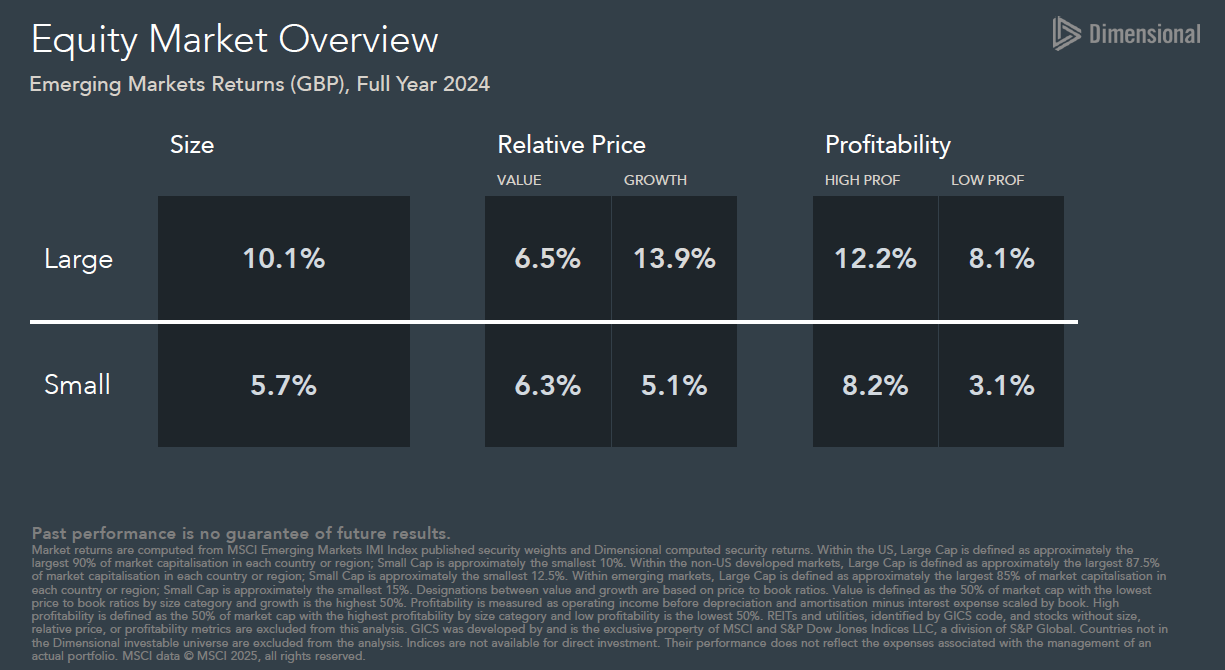

The following charts show how securities with higher expected returns have performed in developed markets, the UK, and emerging markets in 2024.

Developed Market Returns: 2024

- Large caps outperformed Small caps

- Growth stocks outperformed Value stocks within both Small and Large caps

- High Profitability outperformed Low Profitability within Large caps and marginally outperformed in Small caps

UK Market Returns: 2024

- Large caps outperformed Small caps

- Value stocks significantly outperformed Growth stocks within Large and Small caps

- High Profitability stocks underperformed Low Profitability stocks within Large caps and outperformed within Small caps

Emerging Market Returns: 2024

- Large caps outperformed Small caps

- Value stocks outperformed Growth stocks within Small companies but underperformed within Large caps

- High Profitability stocks outperformed Low Profitability stocks within both Small and Large caps

We hope you enjoy these insights. We welcome any feedback so we can provide the information you find insightful and helpful as investors.

Please contact us if you have any questions about the Dimensional investment service.

Approved by Best Practice IFA Group Limited on 23rd January 2025